The One-StoP Shop

From the start, LoanCenter.com was envisioned as a one-stop shop for a consumer's financial needs. This re-design helps make that vision a reality.

The Problem

Customers visiting the site often fell off early in the overly-complicated loan application process, if they were able to find the correct page at all. This made it difficult to increase loan applications, especially from organic visitors.

The Goal

The goal of the the LoanCenter.com website re-design was to provide clearer pathways for site visitors to get to the loan product that fit them best, even if that wasn't what they'd initially searched.

Project Overview

At its inception, LoanCenter.com only housed a few types of loans, but the business unit always intended to expand. Yet, as the company was able to increase its loan offerings, the website became clunky and difficult to navigate. This project was a full re-design with the intention of updating the site map & layout to make browsing and discovery simple. We wanted to make it much easier for a customer to find exactly what they were looking for.

My Role

Visual + UX Designer

For the LoanCenter website redesign, I led the Product Design, both User Experience (UX) and User Interface (UI). I received feedback and constructive criticism from the two business units involved in the business behind the website. From 2021 through the relaunch in October 2022, I worked closely with the Vice President of Marketing to evaluate and resolve pain-points in the browsing & discovery experience.

The Scope

A Full Website Re-Design

The full project started with research and planning, then the design and copywriting, and finally development and re-launch.

The project was a revamp of the look, but more importantly a reimagining of the customer journeys within the site. We intended to make the website easier to navigate, which meant that the process of searching for a loan needed to be rethought.

The Users

Site Visitors

Site visitors are customers looking to learn about or take out a loan. Much of our audience includes people with lower income or credit scores looking for a loan to help improve their credit or get much needed cash. These customers often need to be able to find exactly what they need quickly and easily so they can get back to their lives.

Research

Research was focused on Google Analytics and customer reviews.

With guidance from the Vice President of Marketing, I started by looking at the behavior flow of visitors on LoanCenter.com, noting where on the site the most drop off occurred. We already had good site traffic, both organic and via partnerships, but there was a high volume of customers dropping off during the actual application process. The longer the application went on for, the more drop off we saw.

Screenshot of the Google Analytics Behavior Flow, showing 42k drop offs from 52k sessions. Page names have been blurred for company privacy.

Customer reviews also pointed to the issue: most complaints focused on the long application process. Multiple customer complaints focused on not understanding how to get a pre-qualification or approval on a loan. Clearly we needed to figure out how to make it smoother and easier for customers to get from landing on our site to getting the loan they need.

The Design Process

As both the project lead and the primary designer, I had a number of different responsibilities:

-

Participating in working sessions with stakeholders & business partners to aid the definition of user requirements

-

Investigating and leveraging customer data and insights to inform design decisions

-

Designing the user interface (UI) & user experience (UX)

-

Wireframing & interactions

-

Working with IT for development handoff

Tools Used:

-

Adobe XD was used to layout pages, wireframe, and preview the final product

-

Adobe Illustrator was used to design icons

-

Photoshop was used for photo edits for the website

-

Google Analytics was used for research purposes

From the beginning of this project, I worked closely with the stakeholders, the business units involved in the website, to determine what they most wanted focused on and improved. The LoanCenter website is a dba for two different business units:

-

Wilshire Consumer Credit

-

Westlake Direct

Both companies work together under the Nowlake umbrella, but they each offer different loans. It was important to balance the needs of each business unit, making sure that both sides of the site received equal attention. It was also important to keep the feel of the entire website standardized. Although there are two lenders on the backend, we didn't want to confuse site visitors with two wildly different site formats.

At its most basic, the site map did not change. We knew that we wanted to maintain a home page with subpages easily found via a header and footer menu, and we knew that the main subpages would each outline a loan product.

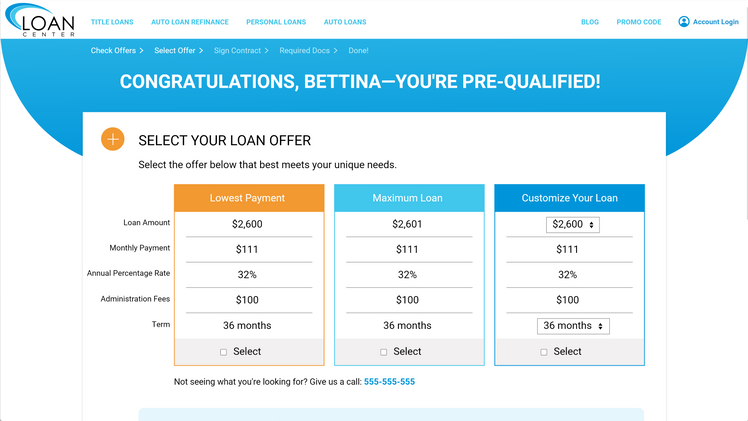

What was most important to the stakeholders and to me was improving the loan pre-qualification and application flow.

The UX challenge for this design was in rethinking what the loan pre-qualification and application process needed to look like. We needed to take into account Legal & Compliance requirements and business requirements, while also conceiving of a more convenient process for customers.

The business units found a third-party vendor they intended to partner with to help pull much of the customer info we needed to lower the number of necessary steps for customers. I worked closely with the business units as well as our vendor contact to understand how pulling info from credit bureau databases could make the process much simpler.

It was with this in mind that we worked together to develop a new flow for each loan type. See below one of the charts I created for clarity:

Once I had an understanding of what the flow needed to look like for both the marketing focused pages and the pre-qualification/application pages, I began work on the interface design. Starting with the already existing company colors, and taking inspiration from the swooping shape of the logo, I drafted and presented a few versions of the homepage to show the business units and the Vice President of Marketing. Once a general design was chosen, reskinning pages that weren't changing and creating a design for new pages was much simpler.

Challenges

As always, this was not the only project on my plate. A challenge for me was making sure that other projects got the attention they needed in order to meet deadlines, while also staying on top of this website. Because of this, careful planning and prioritization were vital.

The most important part of the re-design plan was to re-design the pre-qualification and application process. Beyond the visual re-design, this was what was most important aspect to reaching our goal of reducing drop offs in the pre-qualification and application process. However, for the back end functionality, we needed a third-party vendor. Budget constraints and ongoing contract negotiation meant that, though I created a design for the pre-qualification and approval process, we were not able to implement them on the live website in this first phase.

Despite the challenge presented by waiting for a third-party vendor, the designs are ready to go and can be altered as needed to suit the vendor that is eventually contracted by the business unit.

The Result

The result was a refreshing new design that made the website more modern and attractive. It better fits the overall brand, creating a more cohesive look that uses the brand colors and fits with the logo that was updated only a few years ago.

Next steps: monitoring the website and continuing to the next phase of improvements. The business unit is still negotiating with 3rd party vendors to update the pre-qualification process.